Receiving notice of an upcoming audit can be intimidating. Even planned internal reviews are often a stressful undertaking for auto shops, but shop owners can streamline and reduce hiccups by following a few preparatory steps.

Taking the time to get ready in advance can yield significant savings down the line once the review begins.

1. Review applicable regulations

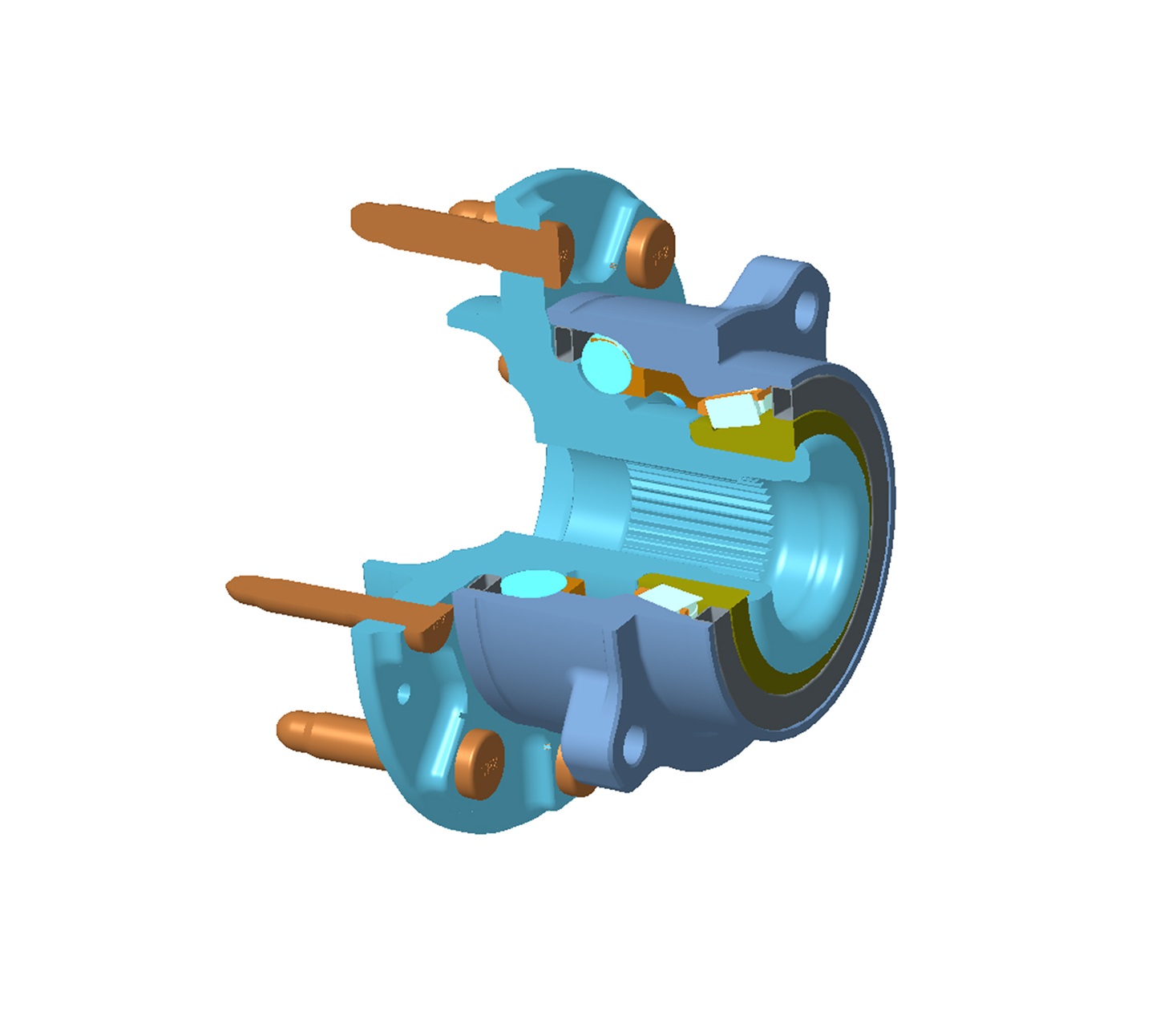

The first step in audit preparation is to review what regulations apply to the shop. National tax compliance is the most obvious area to address, but it isn’t the only one. Automotive businesses may also need to comply with rules from the Workplace Safety and Insurance Board, OEM warranty audits or other standards.

Recognizing what rules a shop must abide by makes it easier to know what information to compile or what changes may be necessary. Be sure to review provincial regulations, too. For example, Ontario repair facilities must follow the Consumer Protection Act, which includes steps that may not apply in other provinces.

Regardless of what standards a shop must meet, employee training is crucial. Safety regulations, proper financial reporting and compliance with customer rights all rely on following set procedures accurately. Consequently, any inadequate training can produce errors that complicate the audit at best and result in fines or other penalties at worst.

Owners should ensure their onboarding process meets all legal training requirements and leaves little room for confusion for workers. It’s also best to perform regular reassessments and refresher training to avoid mistakes from complacency or forgetfulness. Notifying staff of upcoming audits to remind them of best practices is likewise a good idea.

Any audit will also require extensive documentation. The same goes for general compliance, as errors like failing to report certain income can result in fines of $10,000 in some cases. Auto shops can prevent such mistakes and ease the process by becoming more organized in their paperwork.

Make filing proper forms a standard part of the workflow every employee learns about in training. Store files in a dedicated space, ideally with folders to sort them by type and data for easier retrieval. When it comes time for an audit, look through these documents for relevant files and set them aside for faster information sharing with the auditor.

All this necessary documentation is easier if businesses switch to a digital system. Filling out and storing paperwork is faster on a computer, making staff more likely to perform these crucial tasks. Similarly, it’s easier to organize, retrieve and share files electronically.

Backing up mission-critical information to the cloud is also an important step in preventing data loss, which prevents compliance-affecting mistakes. There are also industry-specific programs available that can automate some documentation and reporting tasks. Automating wherever possible will minimize errors and reduce the workload on workers.

5. Consider Professional Assistance

In some cases, it’s best to turn to an audit professional for help. Business owners who have not followed these best practices in the past, have particularly disorganized paperwork or feel overloaded with repetitive work benefit from hiring a third party to manage compliance and reporting for them.

Organizations may understandably be hesitant about paying for such a service. However, CRA penalties can be as high as $24,000 for some forms of noncompliance, so it may be more affordable to seek professional guidance before risking fines. Third-party help is certainly not always necessary, but it is worth consideration.

Audits don’t have to be a headache

When auto shops prepare ahead of time, they can ensure the audit process is relatively painless. Following these five steps will help any entity in this industry get ready for a smoother, more compliant review. Doing so ensures minimal disruption to normal work and can prevent significant losses.

Devin Partida is the editor-in-chief of ReHack.com and a freelance writer. Devin covers business technology, Fintech and auto tech

Image credit: Depositphotos.com

Leave a Reply